Mix CSGO Skins with Blockchain?

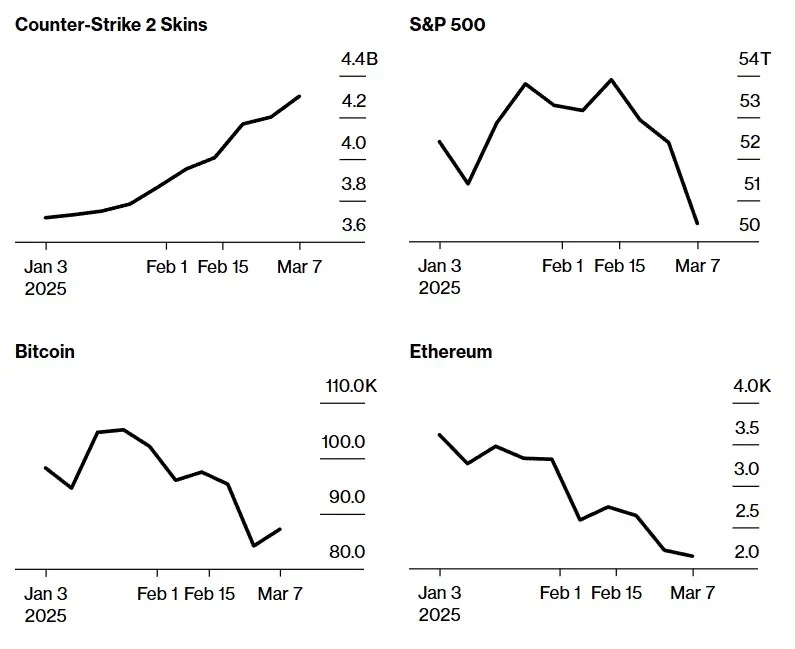

Recently, I came across this chart from a Bloomberg article. CSGO (CS2) skins have surged, while U.S. stocks and crypto have plummeted. In contrast, it seems like gaming not only brings enjoyment but also profit, whereas crypto trading burns you out and leads to losses...

As a former CSGO player who bought a few hundred dollars' worth of skins seven or eight years ago (wish I had bought more!), I started brainstorming about synergies between CSGO skins and blockchain.

CSGO Skins

Overview

CSGO skins are essentially similar to NFTs. Each weapon model has different skin styles, categorized by wear levels (kinda like NFT rarity) and specific randomized patterns (e.g., a fully blue "Case Hardened" AK-47 can be worth hundreds of thousands of dollars).

Broadly categorized:

Weapon Skins: Most common, varying prices depending on models and styles.

Knife Skins: Rare drops (default knives differ significantly from skinned ones), with a high baseline value. Expensive and considered "blue-chip" assets.

Glove Skins: Rarer and pricier than knives. Luxury items, less ideal for small bag.

Stickers: Highly speculative. Some limited-edition stickers (e.g., Titan Holo) can reach up to $60k.

Key purposes of skins:

Aesthetics: Randomly dropped crates (keys cost a few dollars) let players unlock skins. Most players quickly equip common guns with skins, avoiding the bad default looks.

Investment Value: Due to rarity (e.g., knives), prices rise with demand. Illiquid market allows easier manipulation (e.g., pump-and-dump schemes on obscure stickers). Unlike crypto, players are less savvy, making them easy targets.

General Currency: Used as prizes or collateral in gambling.

Trading

Like NFTs, skins are traded via order books. Classic strategies: accumulate, hype, pump, dump. Price charts even resemble TradingView. Watch this Top 5 CSGO Skin Market Manipulations.

The entire market thrives on new players and capital inflow, creating a giant game-themed Ponzi.

Key market participants:

Players: Buy skins for gameplay.

Investors: Profit-driven traders.

Platforms: Facilitate trades (Steam’s official platform is illiquid for cashing out).

Streamers/Pros: Act as KOLs, promoting specific skins (e.g., pro player donk buying opponents’ stickers mid-game).

(Further trading details omitted for brevity.)

CSGO Skins + Blockchain

Let’s explore potential integrations of CSGO skins with blockchain.

1) CSGO Skin AMM

Fun fact: AMMs were inspired by Minecraft’s HyperConomy (2012).

Currently CSGO skins are traded in order book, which is not very efficient, and has the same problem as NFT, where they hang around for days before anyone buys them, so when they are sold they are usually listed directly below the market price, which makes for an easy death spiral.

In order to solve the problem of trading experience, we can make an AMM.

AMM can be done either as a pure offchain trading platform, or mapped to onchain:

In the case of pure trading, we may have to make an Aggregator-like protocol to accept buy and sell orders from all platforms in order to achieve AMM-like efficiency. Alternatively, a liquidity provider could build a separate pool like Sudoswap, which is not really convenient.

If you insist on going to onchain these, you may have to use a price oracle like those in Tokenized RWA, mapped assets to onchain, then make pools. But the problem with this is that it becomes purely trading, and doesn't facilitate the actual exchange of skins.

2) Shorting & Leverage

If CSGO skins could be shorted and leveraged, then wouldn't they go up even more, and also bring the relatively worthless skins back to their own price.

CSGO skins have a rental model, and many people rent skins for 100 days just to short them, or the 7-day trading cooling-off period is essentially a 7-day expiration of a European-style option. Along these lines, we can naturally design a system based on the traditional shorting mechanism. The problem is that we need to add a liquidation mechanism, nowadays, many times the price goes up, the borrower of the skins just rug it, then the platform needs to pay out.

Referring to the perpetual contract, we can also design a cryptocurrency type of CSGO skins derivatives. Instead of delivering the skins directly, we can design a perpetual contract based on the market price of "AWP Dragon Lore". Long and short positions could be opened and traded with leverage, similar to existing cryptocurrency perpetual contracts, with the platform calculating funding fees at regular intervals, etc. etc. etc.

3) CSGO Skin Index Funds

One of the fun things about CSGO skins is that they are broken down into fixed categories by skin type. These categories can be used as index funds.

(pic says skin index, rental index, 10 dollars main weapon index, character skin index, native skin index)

I won't get into the traditional indexing approach. With blockchain, it's possible to do fun things like DAO voting to govern fund composition, fragmentation of super-expensive skins by holding them in an index fund, stake skin to get shares in an index fund, and other weird fun things.

4) Infrastructure

VC-friendly but low-ARR opportunities:

Data Dashboard

Tools like gmgn.ai, which aggregates trading data and market data through an API, provides real-time quotes, historical trends and depth charts, or furthermore, provides a one-click ape and one-click sell function, which simplifies the complexity of the trading process (no need to log in Steam to confirm).

Analytics

Analyze the insider positions of the skin, the KOL positions, and the positions of the pro players, to determine if buying this skin is a good idea or not.

Custody and Security

Build a specialized CSGO skin custody platform, through multi-sig, cold wallet (cold Steam account lol) storage, to protect the user's skin security.

There are many others, such as providing just APIs, insurance platforms, security tools, "MEV", social platforms, community platforms...

But the current pain points such as low efficiency of orders are still essentially the lack of liquidity which comes from steam's limitations, to get these things onchain may theoretically solve those superficial problems (low transaction efficiency, etc.), but can not solve due to Steam.

Additional Points (via DeepSeek)

Centralization Risk: The article compares skins to NFT but does not emphasize the core difference - CSGO trinkets are actually owned by Steam, there is a risk of platform blocking/rule modification (Steam is officially resistant to NFT, after all, it's safe to be your own platform, steady cash flow).

Regulatory arbitrage: Chinese players circumvent foreign exchange controls by trading skins (this is actually feasible, but in practice the losses are too high, unless you really want to wash the money clean, you can't think of anyone who would do this).

Liquidity stratification: High-end skins (dragon snipers/gem blades) are traded on the OTC bulk market, with a price discovery mechanism highly similar to that of cryptocurrency OTCs (this is actually true, as high-end trinkets are basically played by a few big names, much like CryptoPunk holders like 6529).

Wear Economics: A "pseudo-metaphysical" premium exists in the 0.15-0.18 wear range (a small point on the rarity scale).

I’m signing off to play Valorant. So here’s the AI generated ending.

“So, dear agents, next time you dominate with your ‘Howl’ M4A4, remember—it might be the only time you can proudly say, ‘I owned noobs in-game and shorted the market!’ (๑>ᴗ<๑) Just manage your positions… because even the coolest skin can’t hide the pain of eco-round armor buys!”

Amazing article. Tbh I was thinking about building some sort of system that could connect these two worlds and make it easier to invest in CS skins. Would you be open to contact me so we can discuss this further?